I authored this article which appears in the current July/August 2015 edition of Business Xpansion Journal. Below is just an excerpt.

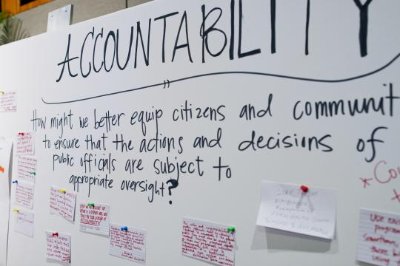

The concept of accountability isn’t new — especially when discussing taxpayer dollars and where they are spent by government agencies. Governments are under constant scrutiny regarding tax revenue and expenditures from their constituents, the media, and the public as a whole. However, there has been an increasing call for accountability when it comes to corporate tax credits and incentives for economic development. Even the Governmental Accounting Standards Board (GASB) issued an Exposure Draft in October 2014 for proposed guidance on tax abatement disclosures. These economic incentive programs draw both critics and supporters, but both seem to agree that most governments are doing a poor job reporting return on investment when providing incentives. And with many state and local jurisdictions fighting over budgetary issues, every dollar is being viewed under the economic microscope.

Issues Driving Increased Awareness

Fierce competition for jobs and investment is also drawing attention to incentive programs and the need for accountability.

Some states are pushing the envelope and attempting to gain the upper hand via new legislation. The Boeing Co. experienced this move earlier this year when Rep. June Robinson, D-Everett, introduced a bill, which would cut into Boeing’s B&O tax break — one that would entirely disappear if Boeing’s Washington employment drops below 78,295. Other states — like Ohio and Texas — already have strong compliance programs to hold companies accountable.

"As a result of increased transparency and heightened awareness around business incentives, the call for accountability is coming whether you like it or not."

Factors Creating Transparency

Call it a generational movement rooted in the Millennials or a societal evolution, but there is generally a drive toward greater social responsibility — and that is fostering a desire for increased transparency on many levels. The GASB proposal is aimed at just that — creating transparency in business incentives. However, it appears the world isn’t ready for the GASB’s transparency.

According to the June 2015 minutes: “…the Board agreed that the expected benefits of the tax abatement disclosures standards will outweigh the perceived costs of implementation.” The final statement won’t be issued until August 2015, but the writing is on the wall. The bigger issue here is how and how much should be reported. At the end of the day it’s a battle between the Freedom of Information Act, e.g., full disclosure and confidentiality.

"The accountability train is pulling into the station

so it's time to get on board or be left behind."

Adopting Proactive Solutions

The best way to ensure your team is collaborating and your company is fully in compliance is to use a set of technology tools that will facilitate the process. Gone are the days when spreadsheets and email would suffice — especially if your company is managing a significant number of incentives. Ideally, a cloud-based solution that addresses your needs for compliance, collaboration and accountability might be the best option, depending on the complexity of your company. Identifying the options and implementing them for your company will also provide the business intelligence you need to make other strategic decisions.

...this article can be read in its entirety at Business Xpansion Journal.

To request a demo or receive more information, please enter your information in the

form below and a member of our team will be in contact with you shortly.